Deduct up to 9X More

With a Self Directed Retirement Plan, you can deduct up to 9X more than a traditional IRA and access a world of alternative investment opportunities.

Get big company benefits, where you are today.

Deduct Up To 9x More

Deduct up to 9x more than a traditional IRA with your Self Directed Retirement Plan. This can be fully tax deductible or mixed with tax free 'Roth' funds.

Tax-Free or Tax-Deferred Growth

Combine the tax-deferral benefits of a self directed IRA with your investments and watch the profits you generate add up faster than ever before.

Reduce Taxable Income

In some cases, contributing the max to your Self Directed Retirement Plan can reduce your tax bracket, which can save you thousands over time!

Make Roth Contributions

Roths are a great way to fund your retirement and generate more tax-free dollars. With the exception of withdrawing before age 59 1/2, all qualified distributions and gains will be federal income tax-free!

Take Loans From Your Plan

Some self directed retirement plans can provide a loan of up to $50k with automatic approval, and you can use the money for any purpose with same day funding.

Access a World of Investments

Invest in real estate, digital assets and cryptocurrencies, precious metals, private equity, mortgage notes and more, in addition to stocks, bonds, funds, and ETFs.

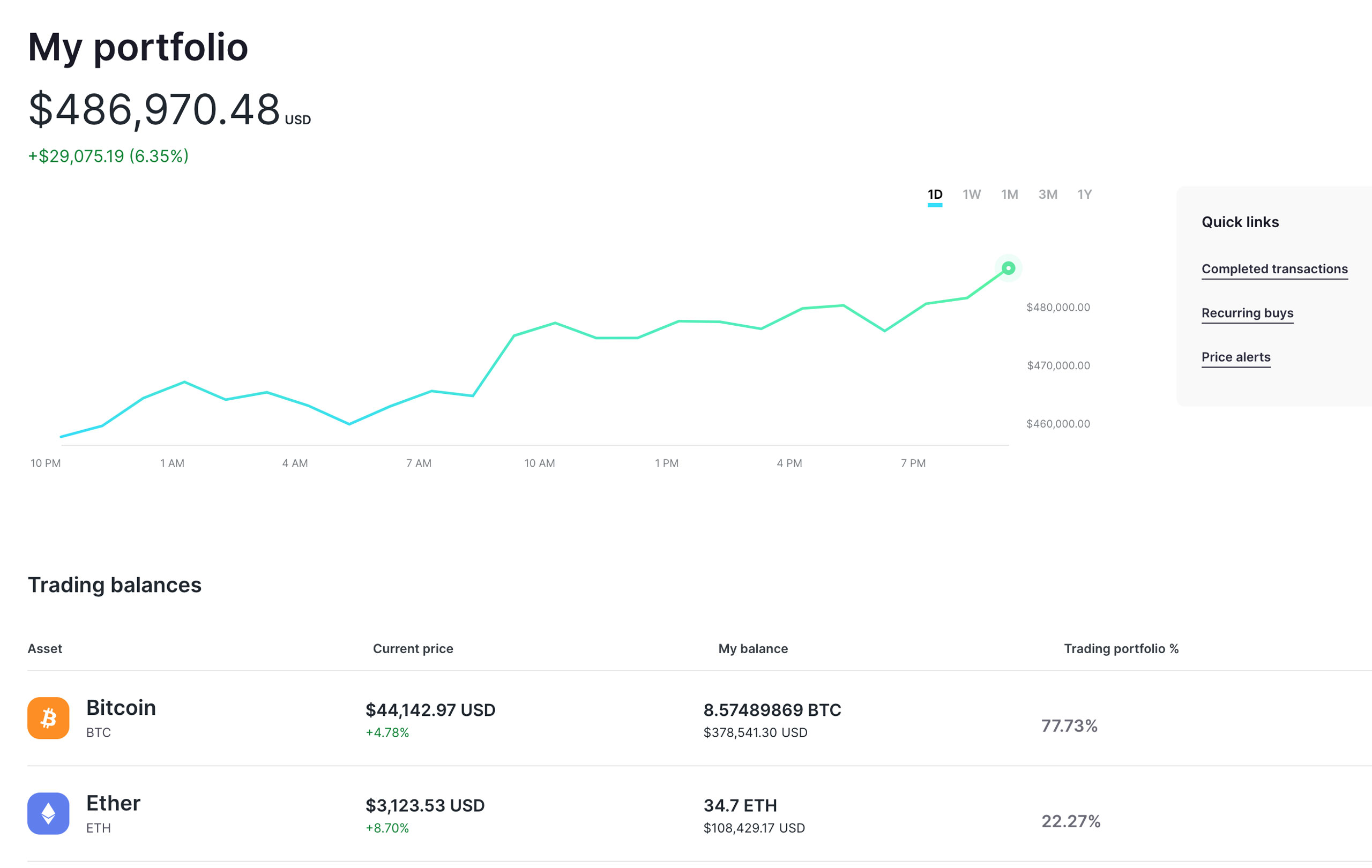

Manage your assets and investments, all in one place

The world of self-directed retirement plans has never been easier thanks to our innovative investment tracker and management portal. Manage all aspects of your financial future on one easy platform!

- 📈 Easily track, buy, sell or hold your investments

- 💸 Make compliant transfers in one click

- 🔒 Data secured by 256-bit encryption

* Certain features shown will be available in Q4 of 2021 at no additional charge.

Say goodbye to high setup fees

We didn’t stop at creating the most efficient self directed retirement plan setup process in the world.

Higher contributions limits than IRAs

Solo 401Ks can allow for employee and employer contributions and offer many tax advantages like higher contribution limits. Allowing solo-owner businesses up to $58k per year vs a Traditional IRA.

Easy Maintenance and Low Fees

We've been perfecting our online setup process for over 16 years, making it the easiest and most cost-effective to use in the world. All plans include lifetime support.

Free Qualified Rollovers

We offer free rollovers from another IRA, 401(k), 403(b), 457, SIMPLE IRA, SEP IRA, Keogh, etc.

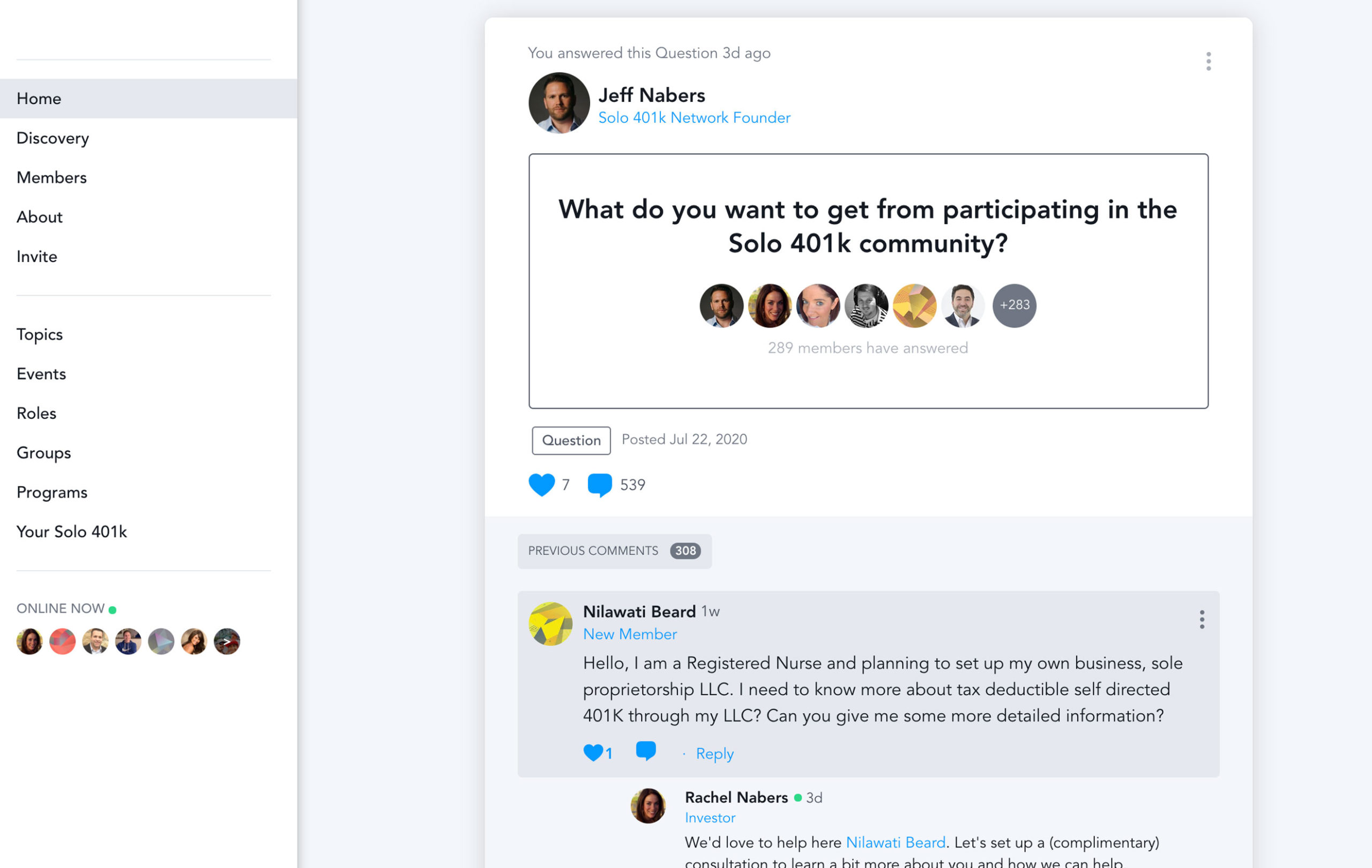

Join our plan owner community

With a Nabers self-directed retirement plan, you take complete control of your financial future and gain the freedom to invest in a wide range of assets, all in one place.

- 🗓️ Weekly webinars on all things self directed retirement

- 📖 Exclusive access to online courses

- 💭 Get answers to your questions from experts

What plan is right for you?

Just answer a few questions and we'll help you identify the self directed retirement plan that is best fit for you.