Your Retirement Powered by Bitcoin

Trade Bitcoin with tax-free or tax-deferred returns and never pay taxes on capital gains.

Trade any cryptocurrency in your retirement plan

- Track, buy, sell, and hold 100% of cryptocurrencies

- Never pay taxes on crypto capital gains

- Traditional and Roth IRAs Available

- Create a tax-advantaged legacy

- Never pay taxes on capital gains

- Build a truly diversified retirement portfolio

- Trade cryptocurrencies in your retirement plan

- Works with all cryptocurrency wallets

Easily track your investments and assets

The world of self-directed retirement plans has never been easier thanks to our innovative investment tracker and management portal. Manage all aspects of your financial future on one easy platform!

- 📈 Easily track, buy, sell or hold your investments

- 💸 Make compliant transfers in one click

- 🔒 Data secured by 256-bit encryption

* Certain features shown will be available in Q4 of 2021 at no additional charge.

Say goodbye to high setup fees

We didn’t stop at creating the most efficient self directed retirement plan setup process in the world.

Watch your money add up faster

Claim Your Tax Deduction, Start Saving And Reach Your Financial Goals Faster

Chart Assumptions

Solo 401k

$56,000 annual contribution

12% growth rate illustrates the potential of alternative investments (real estate, cryptocurrencies, precious metals, private notes, tax liens, private equity, startups, etc)

IRA

SEP IRA

- ✅ Lower your taxes

- ✅ Save more, invest more

- ✅ Grow faster with alternative investments like Bitcoin*

- ✅ Watch your money add up

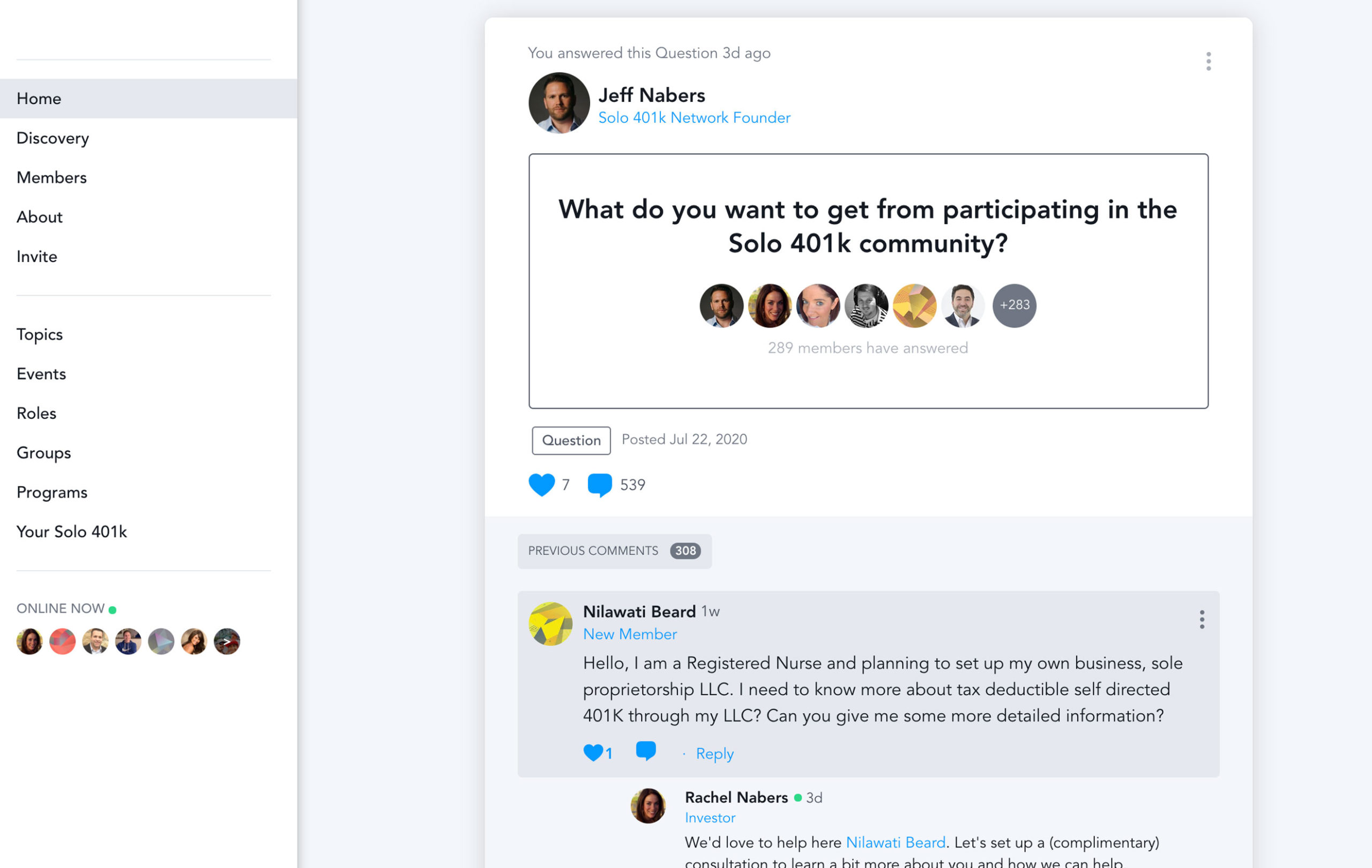

Join our plan owner community

With a Nabers self-directed retirement plan, you take complete control of your financial future and gain the freedom to invest in a wide range of assets, all in one place.

- 🗓️ Weekly webinars on all things self directed retirement

- 📖 Exclusive access to online courses

- 💭 Get answers to your questions from experts

Harness the power of Tax Deferral + Bitcoin

Don’t underestimate the power of compounding your returns combined with tax deferral, especially in an asset class like Bitcoin. Since Self Directed Retirement Plans are fully tax-deferred, you won’t incur capital gains taxes.

Easy Maintenance and Low Fees

We've been perfecting our online setup process for over 16 years, making it the easiest and most cost-effective to use in the world. All plans include lifetime support.

Free rollovers from your IRA

We offer free IRA rollovers another IRA, 401(k), 403(b), 457, SIMPLE IRA, SEP IRA, Keogh, etc.

What plan is right for you?

Just answer a few questions and we'll help you identify the self directed retirement plan that is best fit for you.