Cutting your tax bill to the bone is as simple as investing in cryptocurrency using a tax-deferred or tax-free Self-Directed Individual Retirement Account (SDIRA). Cryptocurrency is an extremely hot financial topic and people still have a lot to learn when it comes to investing. Profits from this innovative technology are expected to be significant during the early years of the rollout that is just getting started. Minimizing the amount of your profits that Uncle Sam collects begins by understanding how the tax laws apply to crypto.

1. Trade Crypto in A Self-Directed IRA (SDIRA)

Taking direct control of your retirement funds comes with many financial advantages. Perceptive investors have been using self-directed IRAs for both owning alternative assets and minimizing the taxes they pay. As an innovative technology, crypto is a natural fit for the SDIRA tax strategy. Having direct control of your assets is about having options. From the start, an SDIRA offers two distinct tax-advantaged investment strategies.

The best-known strategy is the Traditional SDIRA that allows tax-deferred contributions before you even make an investment in an alternative investment such as cryptocurrency. Contributions reduce your annual income and therefore reduce your annual income tax. This happens even before you make a profit on your crypto investment. The profits then grow tax-deferred until your retirement years when taxes become due when withdrawn – typically at a lower tax rate than during your income-earning years.

The popularity of the Roth SDIRA is increasing rapidly as a tax-free method to grow retirement savings. As crypto profits surge, this might well be the better tax-advantaged strategy. The reason is that all of the profits can be withdrawn during your retirement years tax-free. The difference between a Traditional SDIRA and a Roth SDIRA is that with the ROTH account, you pay taxes on the original investment funds upfront. But not on any of the earnings that can accumulate for years and decades before retirement.

Although the highly tax-advantaged SDIRA is a very powerful way to invest in crypto, the Solo 401k can be even more powerful. Annual contribution limits to an SDIRA in 2022 are $6,000 if you are under 50 or $7,000 if you are 50 or older. Solo 401k contribution limits are much higher in 2022 at $61,000 or $67,500 if age 50 or over. If you qualify, you can roll an existing IRA into this higher leveraged retirement account. To learn more, please read the article: Start Investing with your Solo 401k: Buy Cryptocurrency.

2. Grow Crypto Tax-Free with a Roth 401K

The thought of Growing Your Crypto Gains Tax-Free with a Roth 401k should catch your attention. Seriously, although you pay taxes upfront on the original investment funds, by investing in crypto with your Roth Solo 401k you keep 100% of the gains, essentially making it tax-free for you forever! One very important tax pitfall this avoids for crypto investors is the “trading tax.” Because the earnings are 100% tax-free, you reduce the risk of price fluctuations associated with this new technology. For instance, if you bought Bitcoin early in the year and sold it a few months later for a big profit, you would not owe taxes on the gain. If you reinvested a few months later in Ethereum only to see it take a temporary dip in value, you would not feel pressured to sell at a loss to offset the gain you had with Bitcoin. You would be much more comfortable waiting for Ethereum to regain its footing so that you have a tax-free profit from both trades.

Every Solo 401k by Nabers Group automatically includes a Roth 401k sub-account at no extra charge. This gives you the freedom to decide if and how you want to fund, use, and invest your Roth money. We also offer an In-plan Roth Rollover. This is when you convert retirement funds that have not been taxed into an after-tax retirement fund that will be distributed tax-free.

Let’s move on to more ways of lowering your tax bill by investing in crypto…

3. Hold Onto Your Crypto for The Long Term

If you already own crypto or want to invest outside of a tax-advantaged account, you need to know how the IRS taxes this new asset class. As this asset class matures, there are generally three things you can do after you own it:

- Keep it stored while anticipating future value growth (saved).

- Exchange it for fiat money like U.S. Dollars.

- Buy goods and services directly.

Crypto might feel like cash but under U.S. tax law, the IRS classifies cryptocurrencies as property and subject to capital gains taxes. That is a particularly good reason for you to strongly consider holding your crypto in a tax-advantaged account like a Solo 401k or SDIRA. Like any capital asset, you have to pay taxes on it when sold outside of a tax-advantaged account. The crypto tax rate is based on the IRS ruling (2014) that dictated all crypto should be treated like capital assets, rather than a fiat currency like Euros or U.S. Dollars.

That means even if you spend it for goods and services, you trigger capital gains taxes based on increased value over what you paid for it. For example, if you purchased $4,000 worth of Bitcoin and used it to purchase $9,000 in goods or services, your taxable capital gain would be $5,000. However, if the goods and services were only valued at $3,000, you wouldn’t owe anything in taxes since you incurred a $1,000 loss.

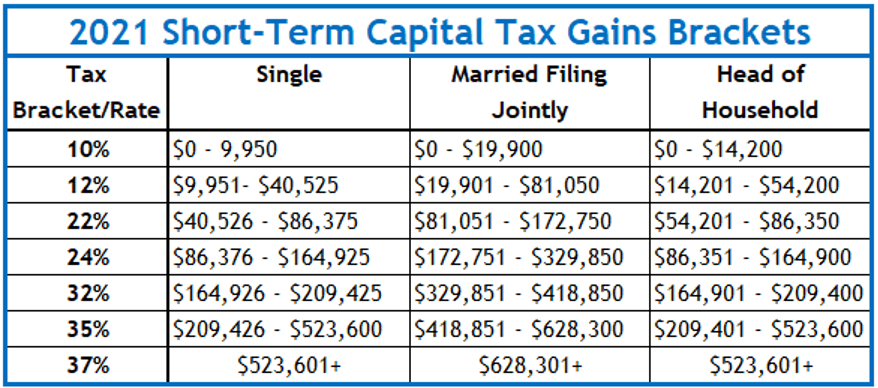

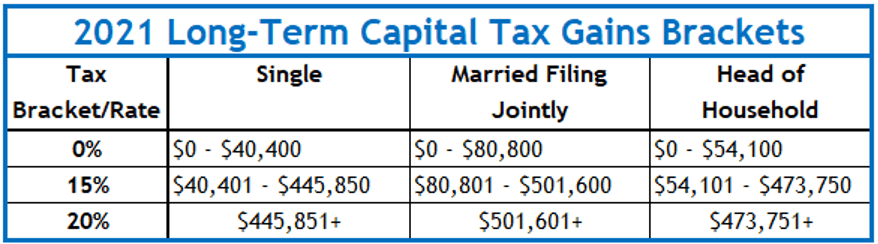

The cryptocurrency tax rate for federal taxes is the same as the capital gains tax rate. That means you need to know the crucial difference between short-term gains and long-term gains. For 2021 tax purposes, it ranges from 10-37% for short-term capital gains and 0-20% for long-term capital gains. Where you fall in the ranges is determined by your annual income level and how long you held the cryptocurrency (holding period).

The long-term and short-term gains are determined by the day after you purchase the crypto asset or make the crypto transaction and continue until the day that you trade/sell/dispose of the capital asset.

When your cryptocurrency has a holding period of 365 days or less, it is taxed as ordinary income and will be subject to short-term capital gains tax. This chart shows the tax rates for short-term capital gains tax in 2021 based on income level:

Long-term capital gains and the applicable tax rate for crypto starts with a holding period of more than 366 days. The tax rates are based on your ordinary income tax rate.

Any of the three transactions listed above will trigger a taxable event. How much tax you owe depends on if the crypto was held long or short term and your annual income. Most taxable events are easy to understand such as selling crypto for U.S. dollars. For instance, buying Bitcoin for $700 and selling it several months later for $1,000 results in a $300 short-term capital gain. Or trading crypto for another asset for a gain. For instance, buying 10 Litecoin for $500 and trade a few months for 1 Ethereum. When you made the trade, 10 Litecoin were worth $3,000. You would incur a capital gain of $2,500 ($3,000 – $500).

Purchasing goods and services with crypto is a new concept. Normally, you wouldn’t be able to trade 1,000 shares of Corporation X stock for a rental property. But with the new crypto technology, the ability to do this is much more likely. For example, you bought 100 Bitcoins for $15,000 in 2017. In 2021, your 100 Bitcoins were worth an astonishing $4,000,000. You spent $500,000 to purchase 2 rental houses in 2021. Fortunately, you’ll be taxed on a long-term capital gain because you held the crypto for more than a year. However, if the transaction had happened inside an SDIRA or Solo 401k, there would not be any tax due at the time of the transaction.

4. Offset Capital Gains with Capital Losses

Another way to lower your tax bill outside of a Solo 401k or SDIRA is known as tax-loss harvesting. Tax-loss harvesting is a tax savings strategy that can help cryptocurrency traders minimize taxes that they may owe on capital gains, or possibly increase an investor’s tax refund.

Tax-loss harvesting can be used with any asset class but crypto price volatility and fluctuations throughout the year can make this particularly effective.

A capital gain or loss is equal to the value of what you receive at the time of disposal (Proceeds) less the value of what you obtained the asset for at the time of purchase (Cost Basis).

Crypto volatility and fluctuations might be timed to reduce or eliminate your tax obligations. For example, Sally purchased 0.5 Bitcoin for $6,000 in June. Sally also sold 0.5 Bitcoin during a dip in the market the same year for $5,000. That generated a loss of $1,000 that is applied to her taxes. Sally took this a step further by using the $5,000 proceeds that she received from the sale of her 0.5 Bitcoin to repurchase 0.5 Bitcoin. The result is that Sally can claim the $1,000 loss on her taxes while still holding 0.5 Bitcoin. Not a bad way to have your cake and eat it too.

5. Leverage Highest In – First Out (HIFO) Accounting

We know that every time you spend, trade, or exchange cryptocurrency it creates a taxable event when done outside of an SDIRA or Solo 401k. We also know that taxes owed are determined by three factors:

- The market value of the crypto at the time of the sale (Proceeds).

- How much you paid for the crypto (Cost Basis).

- The difference between 1 & 2. (Gain or Loss).

You can also use the Specific ID of the crypto to control the Highest In, First Out (HIFO) to create tax savings. Let’s assume that Jack sold 1 Bitcoin for $30,000 this year that he bought two years ago for $6,000. Doing it this way, he would have a taxable gain on $24,000. However, if Jack had a higher cost basis, the resulting gain and the tax bill would be lower. This may be possible using Specific ID.

According to IRS (A39), you can use the Specific ID method to figure out the cost basis of each unit of crypto asset you are trading, selling, or otherwise disposing of. To do this, you must keep accurate records that include all this specific information:

- Date and time of each unit acquired.

- The cost and fair market value of each unit acquired at that time.

- The date and time of each unit sold, exchanged, or otherwise disposed of.

- The fair market value of each unit and the amount of money or the value of the property you received for each unit at the time it was disposed of.

This required information should be available with decent crypto tax software. Using this information, Jack can use Specific ID to sell 1 Bitcoin with the highest cost basis to reduce or eliminate his tax obligation. For instance, Jack may have another Bitcoin that he bought a little over a year ago for $20,000. He can use this Specific ID to reduce his taxable gain from $24,000 down to $10,000.

6. Move to a State with No Income Tax

Where you live can also make a difference in the amount of taxes that you ultimately pay. Several states have no income tax or they tax investment income at a lower rate than income.

Most states tax income from investments and income from work at the same rate. However, nine states — Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont, and Wisconsin — tax long-term capital gains less than ordinary income. These tax breaks take different forms. Typically, these states allow taxpayers to exclude some or all their capital gains income from their taxable income. But others levy a lower rate than the state tax on ordinary income or provide a credit equal to a percentage of the taxpayer’s capital gains.

New Hampshire currently taxes investment income and interest, but it is set to phase out those taxes starting in 2023.

At present, eight states – Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming – levy no state income tax.

However, these states do have other methods of raising tax revenue. The most common is a sales tax. Higher property taxes are also common as are excise taxes. Ultimately it can be a balancing act to determine the lowest tax-cost state depending on your income, spending habits, and lifestyle.

Cryptocurrency Tax Calculator

The IRS changed the 1040 tax form for 2021. It now asks if a taxpayer has either received, sold, exchanged, or disposed of digital currency. The tax preparation software companies are also expecting an increase in the number of people needing to account for crypto taxes. You might find this Cryptocurrency Tax Calculator a useful tool to help estimate taxes whether you received your crypto by purchasing it, as a payment for services, or in exchange for goods.

Start Trading Crypto in a Self Directed IRA or Solo 401k

Now that you are ready, Nabers Group is here to help you navigate to the best full-control retirement account that fits your needs. YOU HAVE OPTIONS WHEN YOU ARE IN CONTROL. You can choose between a traditional tax-deferred account or a tax-free account. Along with those choices you can also select between an SDIRA or a Solo 401k. Both come with your choice of tax-advantaged retirement savings -or- you can combine multiple versions under one umbrella account. Beginning your decision process is as simple as taking the self directed retirement quiz.

Others imitate—we innovate. Our deep history in this space has flourished into a thriving community with special events and unbeatable service. We’re here for the long haul and care about our clients.

Ready to take control of your financial future?

Start where you are. Use what you have. Invest in what you want.

******************

References

IRS ruling (2014)

https://www.irs.gov/pub/irs-drop/n-14-21.pdf

IRS (A39)

Cryptocurrency Tax Calculator

https://blog.turbotax.intuit.com/income-and-investments/cryptocurrency-tax-calculator-50398/